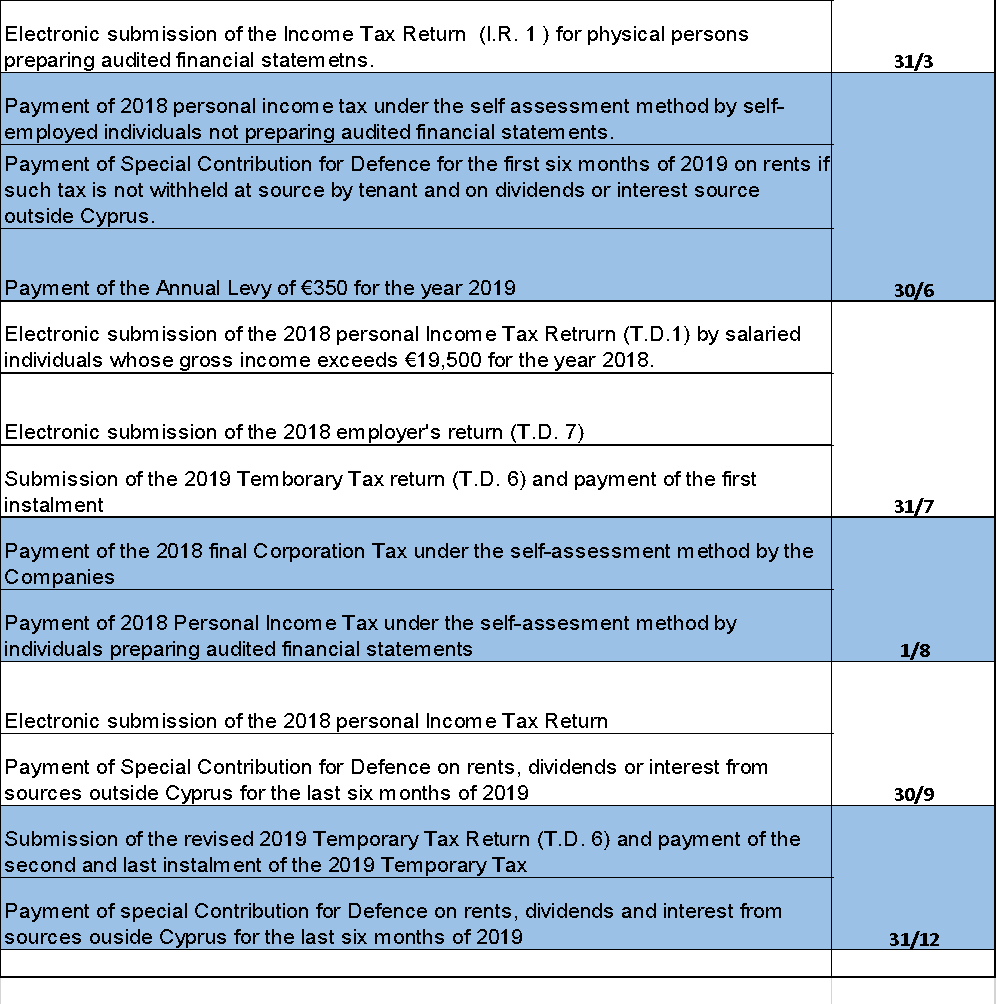

Tax Due Dates

By the end of next month

- Payment of PAYE deducted from employees’ emoluments

- Payment of Tax withheld on payments made to non-Cyprus residents

- Payment of Special Contribution for Defence withheld on payments of dividends, interest or rent to Cyprus tax residents (where the tenant is a Cyprus company, partnership, the Government or local authority).

- Payment of Social Insurance deducted from employees’ emoluments

- Payment of National Health Insurance System Contributions

Interest & Penalties

An administrative penalty of €100 or €200 (depending on the specific case), is imposed for the late submission of a tax return. In the case of late payment of the tax due, an additional penalty at the rate of 5% is imposed on the unpaid tax.

The official interest rate for late payment is set annually by the Finance Minister as showed below:

| Period |

Interest Charge % |

|---|---|

| 1/1/19 - Today | 2.00% |

| 1/1/2017 - 31/12/2018 | 3.50% |

| 1/1/2015 - 31/12/2016 | 4.00% |

| 1/1/2014 - 31/12/2014 | 4.50% |

| 1/1/2013 - 31/12/2013 | 4.75% |

| 1/1/2011 - 31/12/2012 | 5.00% |

| 1/1/2010 - 31/12/2010 | 5.35% |

| 1/1/2007 - 31/12/2009 | 8.00% |

Our Tax Team

Our firms highly experience tax team with extensive knowledge of the tax law and tax environment works closely with our clients, individuals and companies, allowing them to fully exploit and benefit from the numerous tax advances of the Cyprus tax system.

We can advise and assist you or your business on any tax related matters locally or Internationally and together we can develop a clear tax plan to ensure legal and regulatory compliance and at the same time minimizing tax liability.

Our services include the following:

Personal Tax Services

- Personal tax planning

- Preparation and Review of tax computations and tax returns

- Income tax and capital gains tasx planning

- Dealings with enquiries from the Inland Revenue Department

Corporate Tax Services Locally or Internationally

- Preparation and review of tax provisions for financial statements

- Preparation and review of tax computations and determining tax liabilities

- Determining tax consequences of a specific transaction and advise on the proper tax treatment

- Representing clients before tax authorities upon request

- Corporate tax Planning

- International Tax Planning

- Tax structure optimization

- Guidance on double tax treaties

- Tax opinions on contracts and agreements

Accounting

Our firm offers a plethora of high quality and cost-effective accounting and reporting services to help clients to focus on what they do best, growing their business. We strongly believe that accurate and timely financial information is crucial to client’s management to make informed business decisions.

Our highly skilled and experienced accounting team, uses cutting edge technology and professional accounting programs, guarantees that our clients are administered in the most cost-effective way possible.

Our services include the following:

- Book-keeping of company transactions (monthly, quarterly or annual basis)

- Preparation of Management accounts and presentation to the Management monthly, quarterly or yearly

- Procedures for submission of V.I.E.S. returns.

- Payroll Accounting Services

- Invoicing Services

- Training of client’s staff in maintaining proper books and records

- Supervision of clients accounting department

- Assume the role of your accounting department

VAT

Value Added Tax (VAT) is imposed on the delivery of goods and services in Cyprus and on the acquisition or importation of goods from other European Member States. VAT laws and regulations are changing constantly, and this specific area of taxation is one of the most complex areas of taxation in the European Union. Heavy penalties and fines can be imposed if the VAT returns with the relevant authorities are not made correctly and in a timely manner.

Our VAT team which consists of experienced VAT specialists can assist and quite you through this complex procedure and insure that all obligations in this area are met in the most cost-efficient way:

Advisory

- Specific transactions VAT treatment

- VAT reviews to recognise areas of deficiencies and identify risks

- Tax planning advise to optimize the overall Vat tax burden

Compliance

- VAT Registration

- Preparation, review and submission of VAT returns

- Maintenance of accurate and proper VAT records

- Representations with tax authorities on VAT matters

Contacts

Director

George Pitziolis

Director

Yiannis Athanasiou